Black Friday may be viewed as an irritating American import by a nation without Thanksgiving in their diaries, but it could provide a welcome opportunity for pre-owned traders to shift cheap replica watches that have been falling in price all year, and struggling to find a level where customers are ready to buy.

The most over-hyped Swiss made Rolex fake watches, seen as cast-iron investments only 18 months’ ago, have endured the steepest price falls, leaving an army of flippers who flocked to the pre-owned watch market as it boomed after covid, nursing significant losses and struggling to offload stock.

Unworn steel best UK replica Rolex Daytona ref. 116500LN watches have fallen in price by 8.41% on the grey market in the past six months, and are now selling for under £27,000, close to half the peak price of £44,000 according to Chrono24’s price tracking service.

Chrono24 analytics show Rolex GMT Master II ref. 126710BLNR (Batman) copy watches for sale can be bought for £14,500 today, 5.6% less than in May and a third lower than its peak price of £21,000 last year.

Looking across the secondary market, there are a plethora of Black Friday sales that hope to tempt punters to buy now.

Watchfinder is offering up to 25% off for replica watches wholesale from brands including Rolex, Omega and TAG Heuer.

Royal oak jumboA 2011 best fake Audemars Piguet Royal Oak ref. 15202ST.OO.0944ST.02 watches has one of the steepest price drops from £101,000 to £82,000; but that is still far about the wider market price, which has slumped to under £50,000 and still falling.

Watches of Switzerland is holding a Black Friday sale, but there are no deals for top Rolex super clone watches, which are all part of the official Certified Pre-Owned programme that appears determined to sell at prices well above what the market is suggesting.

A 2011 Rolex Submariner Date ref. 16610LV (Kermit) replica watches with Swiss movements, is still marketed at £22,250 despite them widely being offered for under £15,000.

BQ Watches’ always aims to be competitive on price, and a Black Friday sale has shaved a little extra off some highly collectible examples.

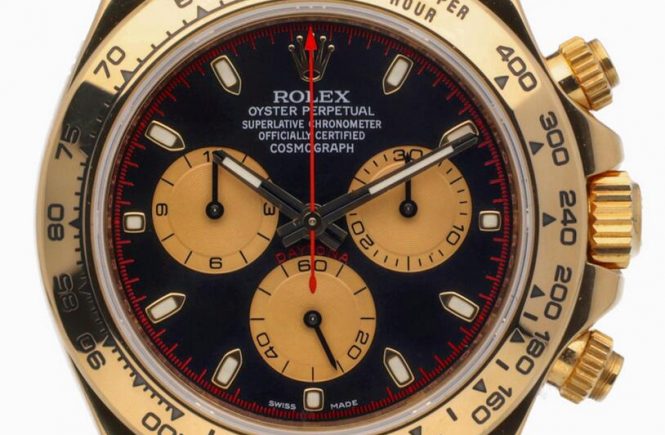

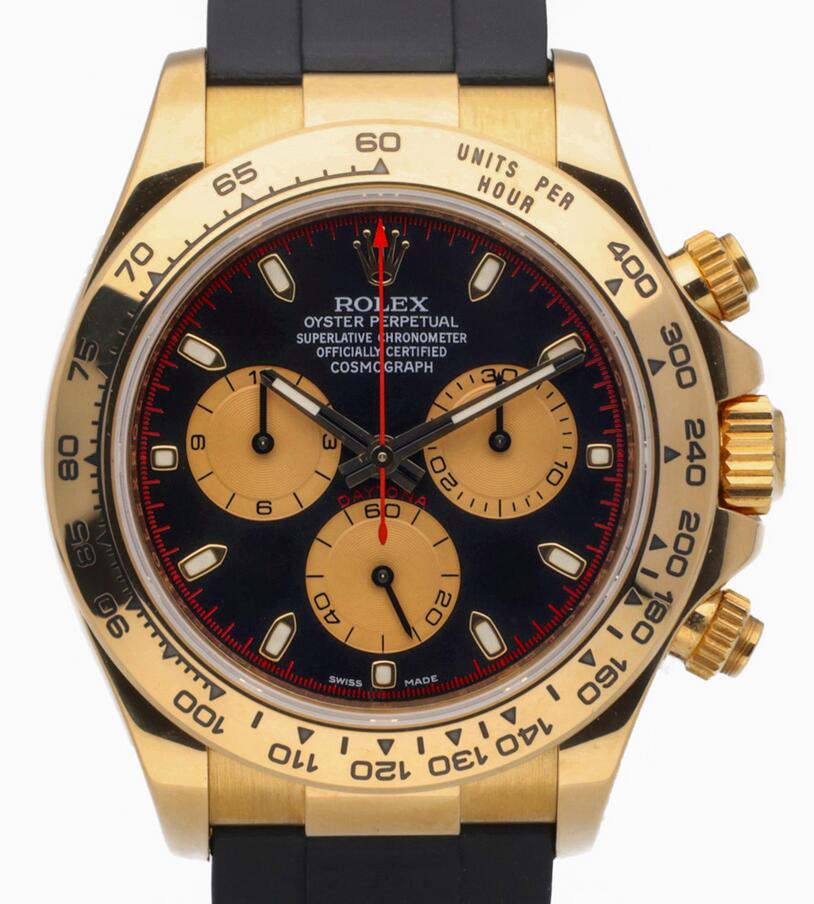

My eye was drawn to this 2007 luxury replica Rolex Daytona watches in 18ct yellow gold with a black chronograph dial, which has had £1,000 shaved off its price to bring it to £30,000.